THE MARKET

Our Niche Market is the Automotive safety

With FGS® – HUD Visor, we have a proprietary technology advantage. Our product is in the niche safety product market. Safety sells.

The automotive safety is our market. We are ready to launch our product within any car model or make. All ranges car drivers need safer product for the drivers. We are open to taking the challenge with any carmaker who believe in our concept. With a previously initial order size, we are targeting to supply more than $2 million units by the 2nd year of production. Our goal is to reach 5% of the global automotive market by the fifth years.

Majors sun visor makers were ready to introduce our product to their customers with brand names[1] like BMW, Daimler Chrysler, Cadillac, Porsche, Jaguar, Rolls Royce, and Ferrari.

The Market

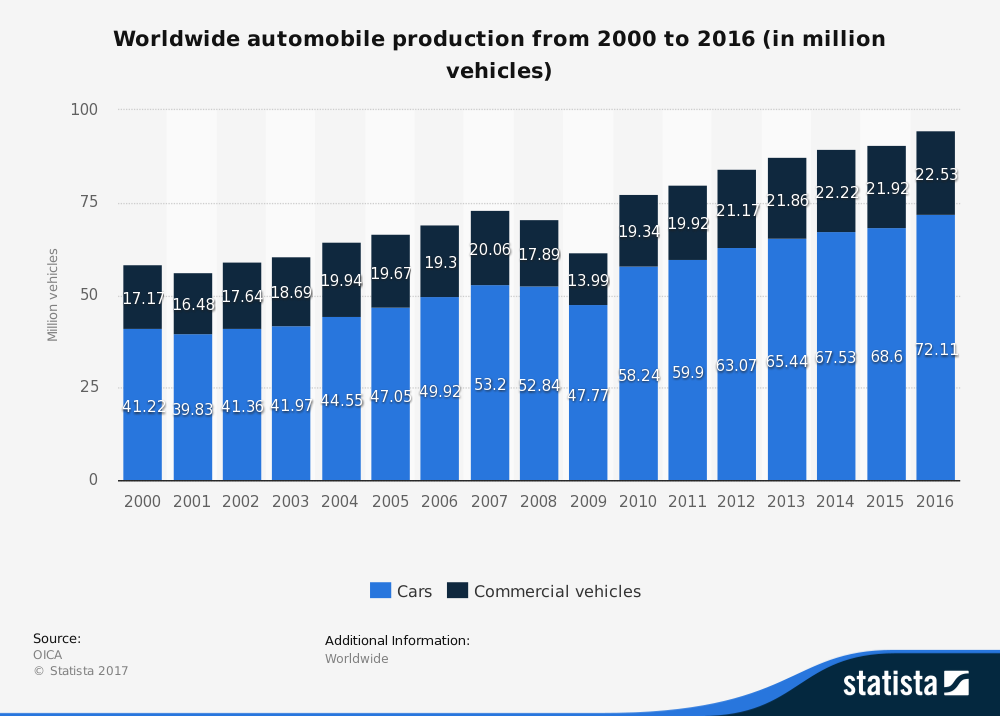

The statistic depicts global car sales by the manufacturer in 2016. U.S.-based automotive manufacturer GM’s global car sales came to just shy of 10 million vehicles in 2016. Over the past decades, China has emerged as one of the main growth markets for players in the global automobile industry, with car sales amounting to 24.4 million vehicles in 2016. Iran is one of the most exciting markets in terms of passenger car production. Follow this link to get access to the top 100 automotive and automotive part companies list.

Leading automobile manufacturers worldwide

Worldwide car sales are expected to reach 77.8 million units in 2017. Increased demand from Chinese customers is predicted to offset sluggish car sales in Brazil and Russia, where a lack of consumer confidence and Western sanctions are adding to economic uncertainty.

The ranking of the major automotive companies in terms of brand value includes the leading automotive manufacturers Volkswagen, Toyota, General Motors and Renault-Nissan. The Toyota Motor Corporation sold around 10.18 million light and commercial vehicles in 2016. Toyota’s main markets include Japan and the United States. The U.S. is the second largest market for passenger vehicles worldwide. In March 2017, the U.S. automotive industry reported some 1.6 million vehicle sales. The upward trend in the world’s second-largest market for passenger vehicles is set to continue through 2018. In light of an aging light vehicle fleet, a growing number of people will also likely replace their old vehicle with a new one. On average, U.S. passenger cars are 11.6 years old. In the United States, the Toyota Camry and the Toyota Corolla/Matrix are ranked among the best-selling car models.

[Courtesy: http://www.statista.com]

FGS® Visor and Cars Market Segmentation’s

Our market segmentation is referring to the car market classification published by the magazine “Automotive News”* in 1996, but our knowledge of the market allows us to reduce these classifications in 5 ranges according to the FGS® Visor models (according to US. Market only).

| Market Analysis | ||

| Potential Customers/Model | Customers | Growth rate |

| LUXURY FGS | 2,002,198 | 5% |

| MODERN FGS | 3,412,797 | 5% |

| CLASSIC FGS | 3,520,887 | 8% |

| TRUCKS (Light) | 4,664,726 | 5% |

| Other | 1,600,000 | 3% |

| Total | 15,200,608 | n.a. |

FGS® Visor Market Segmentation

[1] Names given for illustration only, Lupsor System Inc. has no contract with any of these companies.